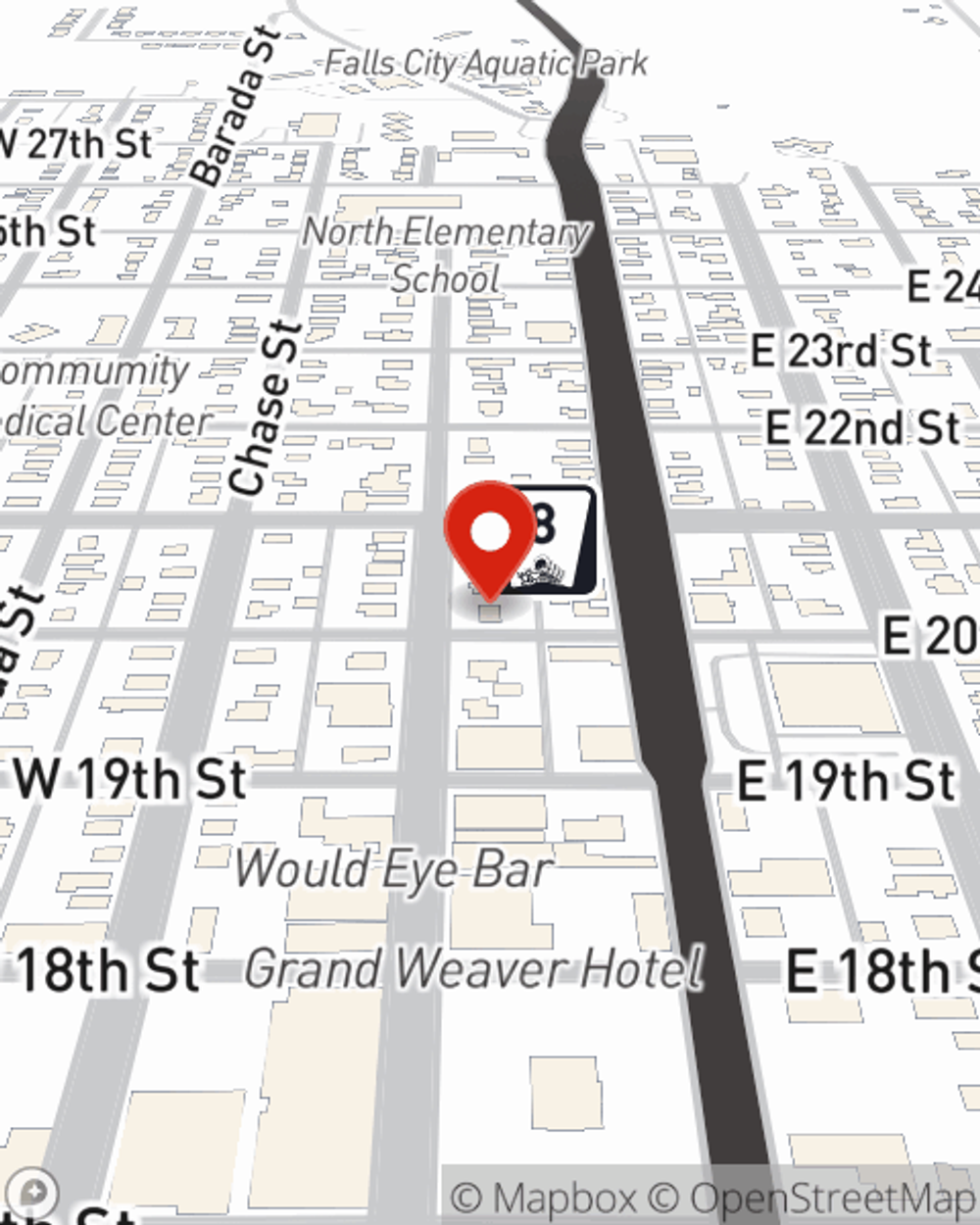

Business Insurance in and around Falls City

Searching for coverage for your business? Look no further than State Farm agent Matt Kirkendall!

Cover all the bases for your small business

- Verdon

- Rulo

- Stella

- Hiawatha

- Shubert

- Brownville

- Mound City

- Auburn

- Rock Port

- Nemaha

- Salem

- Dawson

- Sabetha

- Fortescue

- White Cloud

- Humboldt

- Nebraska City

- Table Rock

- Du Bois

- Tecumseh

- Pawnee City

- Craig

- Tarkio

- Fairfax

Coverage With State Farm Can Help Your Small Business.

As a business owner, you have to think about all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent Matt Kirkendall. Matt Kirkendall gets where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

Searching for coverage for your business? Look no further than State Farm agent Matt Kirkendall!

Cover all the bases for your small business

Get Down To Business With State Farm

Whether you are an insurance agent a dentist, or you own an art gallery, State Farm may cover you. After all, we've been into small business insurance since 1935! State Farm agent Matt Kirkendall can help you discover coverage that's right for you and your business. Your business policy can cover things such as business liability and buildings you own.

It's time to get in touch with State Farm agent Matt Kirkendall. You'll quickly discover why State Farm is one of the leading providers of small business insurance.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Matt Kirkendall

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.